QR Pay, or Quick Response Code payments, is a modern and convenient method of facilitating financial transactions using QR codes. Here’s a step-by-step breakdown of how QR Pay works:

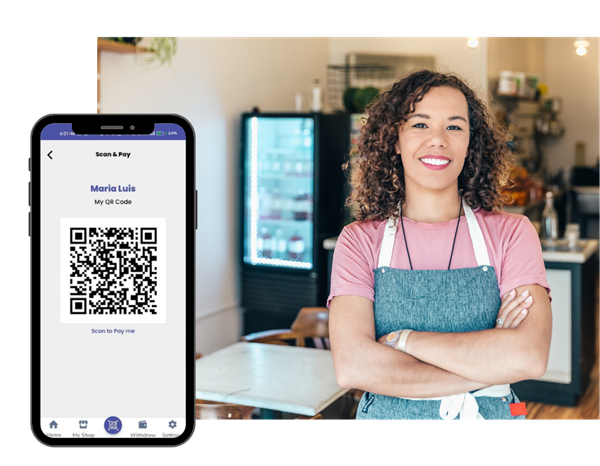

To use QR code payments, you need a mobile payment app that supports this feature. Common examples include apps like PayPal, Venmo, Apple Pay, Google Pay, and various banking apps.

Download the chosen payment app from your device's app store. Follow the installation instructions and set up your account. This usually involves linking a bank account or credit/debit card to the app.

Connect your bank account, credit card, or other payment methods to the app. This step ensures that funds can be withdrawn or charged when making transactions.

If you're the payer, select the option to scan a QR code. Point your device's camera at the QR code displayed by the payee.

The app may prompt you to enter the payment amount or confirm the details of the transaction.

Both the payer and payee typically receive a confirmation of the transaction. This confirmation may include details such as the transaction amount, date, and the parties involved.

QR code payments offer several advantages, contributing to their popularity and adoption in various payment systems. Here are some reasons why people may choose QR code payments:

QR code payments are convenient for both consumers and merchants. Users can make transactions by simply scanning a code with their mobile device, eliminating the need for physical cash or cards.

QR code payments are accessible to a wide range of users, as they only require a smartphone with a camera and a compatible payment app hardware

QR code technology is cost-effective to implement for businesses. Merchants can generate QR codes easily, and there is no need for expensive point-of-sale terminals or card readers.

Lacinia eleifend letius parturient a aliquam ultrices interdum mollis ut. Interdum lorem nunc fames fringilla et posuere.

Lacinia eleifend letius parturient a aliquam ultrices interdum mollis ut. Interdum lorem nunc fames fringilla et posuere.

QR code payments often incorporate encryption and security features to protect user data. Additionally, the use of mobile device security measures, such as biometrics (fingerprint or facial recognition) or PINs, adds an extra layer of protection.

The adoption of international standards for QR code payments enhances interoperability. This means that users can make payments across different platforms and services seamlessly.

Users can often track their transactions in real-time through the payment app, providing transparency and better financial management.

One of the most compelling reasons for the adoption of QR code payments by small businesses is the low implementation costs associated with this technology.

Unlike traditional card payment systems that often require expensive point-of-sale terminals, QR code payments can be facilitated with nothing more than a smartphone or tablet equipped with a camera. For cash-strapped small enterprises, this presents a viable and affordable option to modernize their payment processes.

Just scan and pay—no need for complicated steps or lengthy processes.

QR Pay prioritizes the security of your transactions, providing peace of mind with every payment.

Join a growing network of merchants and users embracing the ease of QR Pay.

Join the QR Pay revolution and enjoy the convenience of instant, secure, and versatile payments. Simplify your transactions, one scan at a time.

LubyNet is leading mobile finance solution provider and All-in-one solution for Retail, Restaurant and Stores. We are specialised in digital transformation in finance industry including software for Small Business, NFC payment consultation, QR Pay and MPOS Device .

LubyNet is a registered trademark of Lubynet ISO Inc. Lubynet ISO Inc is ISO partner of United Payment Sysems LLC. Merchant accounts and payment are process by

Esquire Bank – Jericho, NY, Commercial Bank of California – Irvine, CA & Wells Fargo Bank N.A. – Concord CA

WhatsApp us