These days, practically every business must accept credit and debit card payments. A reliable card processing company in the USA is essential because it anchors your entire revenue flow. With so many providers competing for attention, choosing the right partner matters. Along with secure transaction services, businesses also benefit from Digital Wallet Payment Solutions in USA, helping them meet modern customer expectations and stay ahead in the digital payment landscape.

Selecting the right partner is much more than just taking money. Your bottom line, customer experience, and cash flow are all impacted by a good processor. Profits can be rapidly eroded by an ineffective or expensive system, but growth can be stimulated by a safe and adaptable one.

Clearly defining your business needs should be your first step. Consider this:

The answers to these questions will help you choose the best card processing company and significantly narrow the scope of your search. Your search will be greatly narrowed by the answers to these questions, which will also assist you in selecting the best card processing company in the USA for your circumstances.

Three mains areas that need to pay attention to: Pricing, Technology, and Service.

Company charges in different ways, sometime payment processing fees can be confusing (like one flat rate, different levels of pricing, or a base cost-plus extra fees). Please Pay attention to:

Businesses that process a lot of payments often save money with interchange-plus pricing. This pricing shows the fixed bank fee separately from the processor’s added fee, so it is very clear and transparent.

For small businesses that don’t process many payments, flat-rate pricing can be easier to understand. It stays the same for every transaction and is more predictable, like the pricing some companies offer on the list of card processing companies in the USA.

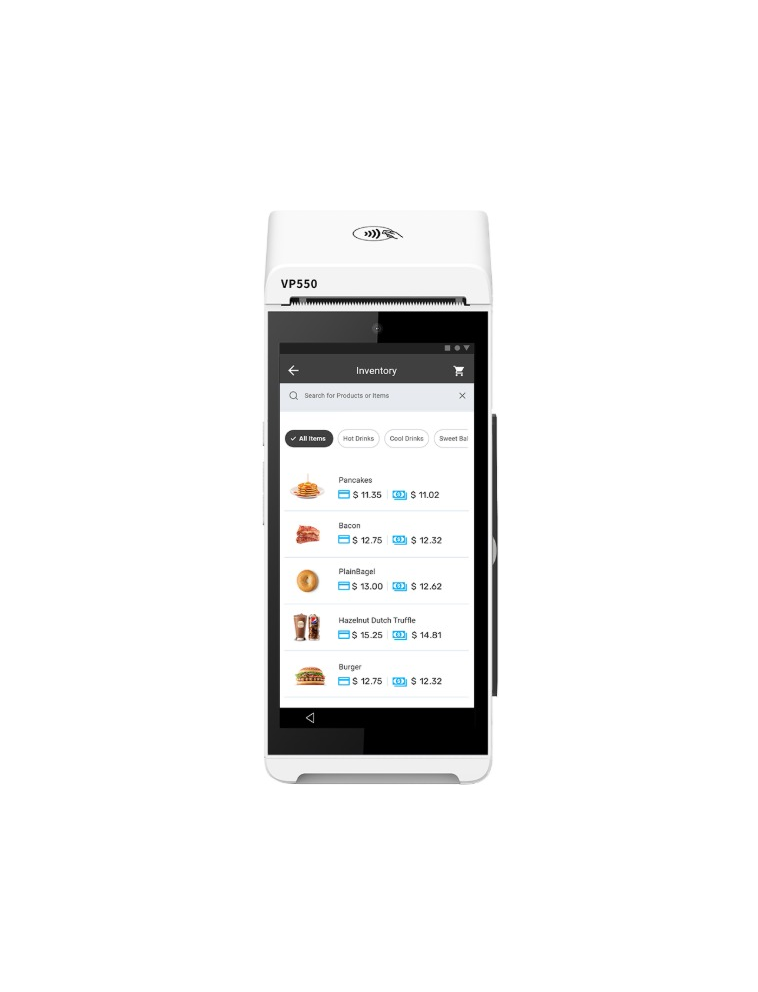

Your processor should offer a payment gateway that integrates seamlessly with your existing systems. Technological considerations include:

Payment Methods:

It is important to check that the payment processor supports all major credit cards,(Eg. Visa and Mastercard). Additionally, do the processor accommodate modern payment options such as digital wallets, for example, Apple Pay and Google Pay.

Hardware:

Security:

In the world of payments, problems can lead to immediate lost sales. Look for company that Reliable and provide 24/7 customer support. The company with a strong reputation and high merchant retention rates. The level of support can often be the deciding factor among the Top card processing company in USA.

Notable Options on the List of Card Processing Company in USA

While the “best” company is relative to your business, the List of card processing companies in USA includes major players who cater to different segments:

Finally, your choice of a Card Processing Company in USA should be treated as a strategic partnership. Don’t rush the decision, compare quotes, contracts, and prioritize long-term partnership over the lowest initial rate.

LubyNet is leading mobile finance solution provider and All-in-one solution for Retail, Restaurant and Stores. We are specialised in digital transformation in finance industry including software for Small Business, NFC payment consultation, QR Pay and MPOS Device .

LubyNet is a registered trademark of Lubynet ISO Inc. Lubynet ISO Inc is ISO partner of United Payment Sysems LLC. Merchant accounts and payment are process by

Esquire Bank – Jericho, NY, Commercial Bank of California – Irvine, CA & Wells Fargo Bank N.A. – Concord CA

WhatsApp us