In the modern high-speed digital marketplace, any company, whether it is a small local store, or a developing online retailer, must have a safe and stable means of allowing customers to make money. That is the reason why it is critical to select the correct card processing service in USA. As the number of customers cherishing the use of the credit card and debit card in their daily buying activities increases, merchants require a system of payment that is quick, safe, and simple to operate.

An effective card processing solution is one that does not only finalize a transaction. It assists companies in streamlining, enhancing customer experience and ensuring financial precision. Whether it is the in-store payments or online purchases, the appropriate provider will now make sure that each and every swipe, tap, or an online payment accommodates without any delays.

The United States payment industry is very competitive, and the customer requires trouble-free and secure payments. An affordable card processing service in USA enables companies to accept large credit and debit cards, mobile wallets payments, and recurring bills options with a Credit card processing company in USA.

Regardless of whether you are operating a retail outlet, restaurant or an e-commerce or service-based organization, having good payment system will create customer confidence, and lessen the customer frustration in the checkout area.

A decent card processing partner will also defraud your business and reduce a chargeback with greater verification tools. Having real-time monitoring and encrypted transactions, businesses are also sure to make payments as well as leaving sensitive material out of danger.

Expectancies of Selecting a Untroubled Card Processor.

The collaboration with a robust card processing service in USA has a number of major benefits with a Card processing company in USA:

Quick and Safety Transactions.

Any business must have its efficient and reliable payment process. The systems that are used today maintain that the payment can be granted within several seconds, eliminating customer waiting time and contributing to increased satisfaction.

Clear-Sighted Credit Card Processing Rates.

Price is an issue to any merchant. A trusted provider also provides competitive and transparent credit card processing rates, which can then assist a business to maintain a predictable cost. Flat-rate pricing or interchange-plus, which one do you prefer to use? Knowing your charges is the key to making more financial decisions.

Incorporated Merchant Services.

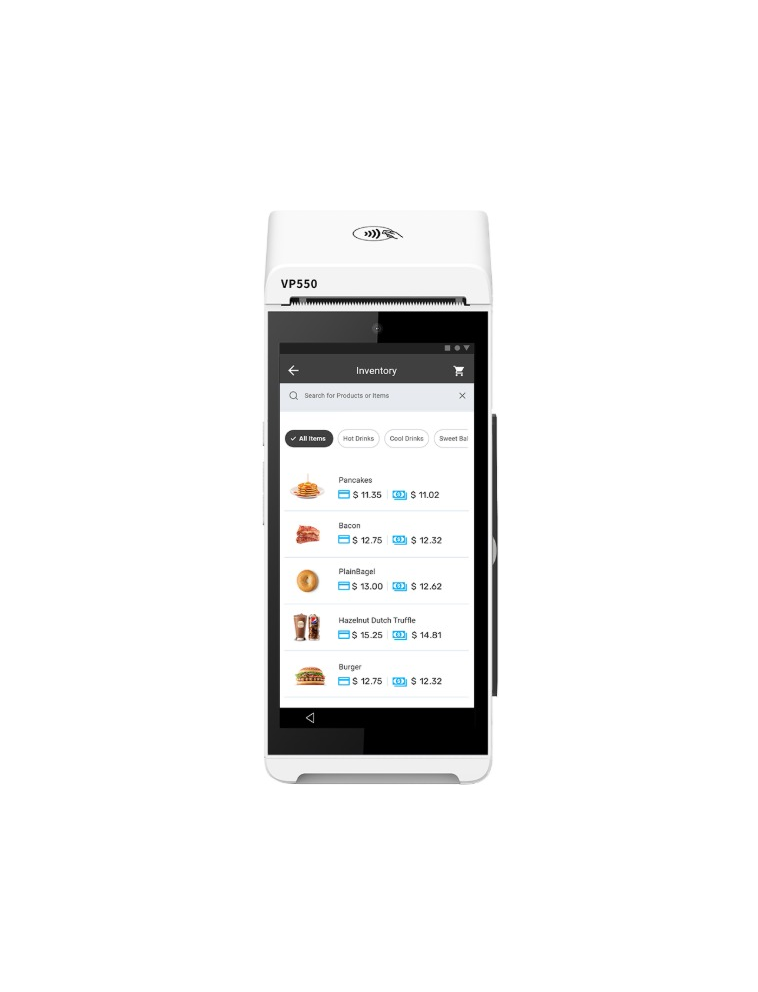

Much of the providers go beyond transactions by including the entire merchant services. These are payment terminals, point of sale systems, mobile readers, invoicing software and analytics dashboards. Through the tools, businesses can be improved in terms of revenue tracking, sales management, as well as in terms of the overall operations.

Online Businesses- Secure Payment Gateway.

In the case of e-commerce companies, the payment gateway must be reliable. Powerful gateway enables the companies to take payments online safely in forms of fraud detection, tokenization, and identification of the customers. This will provide efficiency in the transaction process and minimize chances of fraud.

Interoperability With varieties of payments.

Clients now do not only use cards. It is a service based on a versatile processing that supports:

Contactless payments

Mobile wallets

Online checkouts

Recurring billing

In-store EMV chip payments

Such flexibility assists enterprises and businesses get more customers and remain competitive.

Customer satisfaction is not merely about the quality of product. Customer experience in paying is huge contributing factor in the way individuals perceive a company. A wait or untrustworthy check out may create frustration and lost purchases. This is the reason why a reliable card processing service in USA is essential.

Quick approval and alternative payment systems coupled with a safe authentication system guarantee an easy process each time. Customers who have the confidence of using their cards will come back and will also refer others to the business.

To identify the right provider, you need to find a provider based on your industry, volume of transactions, and money payment. The following are some of them to be considered:

There will be a reliable partner to help in compliance requirements, establishment, and assistance in the long run.

Trustworthy payment processing is now not a choice anymore, but a must. A powerful card processing service in USA also enables the businesses to process payments safely, increase customer confidence, and expand effectively. Your business can run in the modern digital economy with confidence with added features such as merchant services, an open credit card processing rates, and secure payment gateway among other features.

Be it the construction of an online store or the modernizing of the physical checkout system, picking the appropriate provider is the initial action toward creating a smooth transaction process by your team, as well as your customers.

LubyNet is leading mobile finance solution provider and All-in-one solution for Retail, Restaurant and Stores. We are specialised in digital transformation in finance industry including software for Small Business, NFC payment consultation, QR Pay and MPOS Device .

LubyNet is a registered trademark of Lubynet ISO Inc. Lubynet ISO Inc is ISO partner of United Payment Sysems LLC. Merchant accounts and payment are process by

Esquire Bank – Jericho, NY, Commercial Bank of California – Irvine, CA & Wells Fargo Bank N.A. – Concord CA

WhatsApp us