Businesses operating within these difficult sectors know that having accessible and dependable High-Risk Merchant Services in USA is a business requirement to be able to function smoothly. Because of the nature of their business, High-Risk merchants involve a great deal of complexity within their operations such as strict underwriting and having to deal with higher-than-normal chargeback and fraud activity, making having a provider that understands their unique and customized needs a priority. When these businesses have the right high-risk payment partner on their team, they can accept payments with much financial risk and compliance worries.

Unlike traditional payment solutions, high-risk payment processing in USA is uniquely created for industries that have a heightened risk profile such as the adult entertainment, CBD, travel, credit repair, gaming, and subscription-based businesses, including those that rely on Casino Payment Solutions in USA. These types of businesses need robust and reliable systems that can accommodate high transaction volumes, international customers, and a higher threat of fraud.

High-risk payment processors provide:

Quicker, and more dependable approvals.

Support for multiple currencies.

Risk scoring and fraud detection.

Ability for recurring billing.

Tools to reduce chargebacks.

With these systems, merchants are able to keep their business activities continuing to grow without a loss of abnormal opportunities.

Getting a merchant account is never easy, but it can be even more challenging for high-risk merchant businesses. However, a specialized high risk merchant account provider offering High-Risk Merchant Services in USA can make that challenge a lot easier. These providers create strategy models specifically designed for these businesses to make sure that they stay compliant with the requirements of different banks and card networks.

In these cases, a high-risk merchant account provides:

A personalized account

More leeway in processing limits

Support from customers in other countries

Advanced systems to detect fraud and other chargebacks.

Frauds in these industries also make enormous risk businesses vulnerable to attacks of all kinds, which is why it is important to secure processing for high-risk businesses with Secure payment processing in USA. A number of security features designed for specific transactions include behavioral analytics, encrypted tokenization, and two-factor authentication.

Secure processing provides the following:

Less fraudulent attempts

Less risk in general

Customer data is safeguarded

Approval is more easily granted

Implementing security in your systems is a must. This is the most secure design for high-risk payments processing.

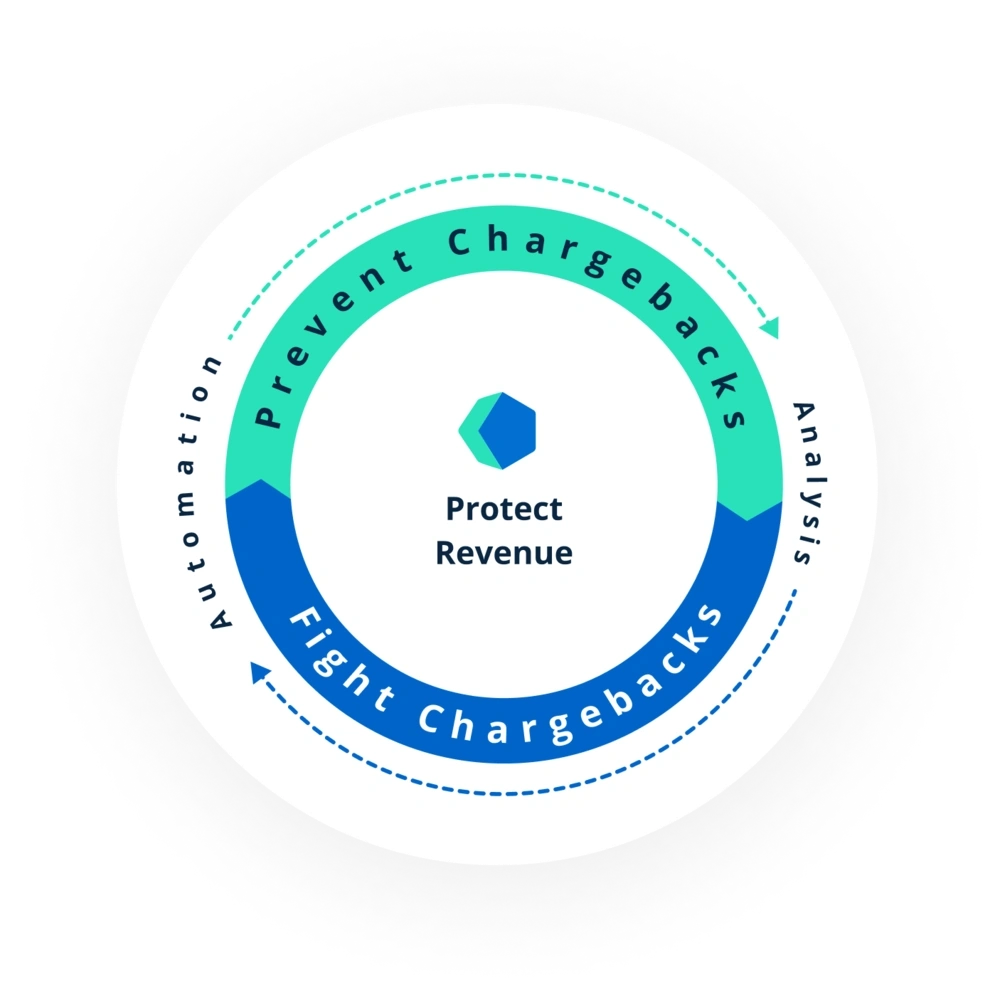

Managing disputes is one of the most challenging elements in high-risk merchant accounts. USA chargeback protection services help to minimize and even control the number of chargebacks using alert systems that provide early notification for disputes.

Advantages include:

Good chargeback management allows companies to keep good working relations with more banks and processors

Online payment gateway for High-risk merchant processors allows seamless and secure transactions and payments from any part of the world. Such payment gateways offer features that aid in PCI compliance, which include strong customer authentication, various payment methods, and easy connections to websites, CRMs, and billing software.

The right choice of High-Risk Merchant Services in the USA will either result in business growth with the absence of an operational headache or the contrary. In competitive and heavily regulated markets, high-risk merchants can successfully thrive because of effective chargeback mitigation, secure payment processing, and reliable merchant accounts.

LubyNet is leading mobile finance solution provider and All-in-one solution for Retail, Restaurant and Stores. We are specialised in digital transformation in finance industry including software for Small Business, NFC payment consultation, QR Pay and MPOS Device .

LubyNet is a registered trademark of Lubynet ISO Inc. Lubynet ISO Inc is ISO partner of United Payment Sysems LLC. Merchant accounts and payment are process by

Esquire Bank – Jericho, NY, Commercial Bank of California – Irvine, CA & Wells Fargo Bank N.A. – Concord CA

WhatsApp us